Leading Reasons to Choose VA Home Loans for Your Following Home Acquisition

Leading Reasons to Choose VA Home Loans for Your Following Home Acquisition

Blog Article

The Necessary Overview to Home Loans: Opening the Benefits of Flexible Funding Options for Your Dream Home

Browsing the intricacies of home lendings can usually really feel overwhelming, yet comprehending versatile funding choices is crucial for prospective property owners. VA Home Loans. With a selection of funding kinds offered, consisting of adjustable-rate home loans and government-backed alternatives, debtors can tailor their funding to straighten with their private economic scenarios.

Recognizing Home Loans

Recognizing home mortgage is crucial for potential homeowners, as they represent a substantial financial commitment that can affect one's financial health for many years to come. A home mortgage, or home loan, is a kind of debt that permits people to obtain cash to acquire a residential or commercial property, with the home itself serving as collateral. The loan provider gives the funds, and the debtor consents to pay back the lending quantity, plus interest, over a specific period.

Key components of mortgage include the principal quantity, rate of interest, funding term, and regular monthly payments. The principal is the initial finance quantity, while the rate of interest figures out the cost of loaning. Lending terms normally range from 15 to three decades, influencing both regular monthly settlements and general passion paid.

Kinds Of Flexible Funding

Versatile funding options play a vital function in suiting the varied needs of homebuyers, enabling them to tailor their mortgage options to fit their monetary circumstances. Among the most prevalent sorts of versatile financing is the variable-rate mortgage (ARM), which offers an initial fixed-rate period complied with by variable prices that change based on market conditions. This can give reduced first payments, appealing to those that expect income development or plan to relocate before prices adjust.

One more option is the interest-only home mortgage, allowing debtors to pay just the passion for a specified period. This can cause lower regular monthly payments at first, making homeownership extra easily accessible, although it might lead to larger repayments later.

Furthermore, there are additionally hybrid loans, which integrate functions of fixed and variable-rate mortgages, giving stability for a set term complied with by changes.

Last but not least, government-backed car loans, such as FHA and VA financings, offer flexible terms and lower down payment demands, providing to newbie customers and experts. Each of these options presents one-of-a-kind benefits, allowing homebuyers to select a financing service that lines up with their long-lasting monetary objectives and individual circumstances.

Advantages of Adjustable-Rate Mortgages

How can adjustable-rate home mortgages (ARMs) benefit property buyers looking for budget-friendly funding options? ARMs provide the capacity for reduced initial rate of interest contrasted to fixed-rate mortgages, making them an appealing option for customers looking to reduce their monthly repayments in the very early years of homeownership. This preliminary period of lower prices can considerably boost affordability, enabling property buyers to spend the financial savings in various other priorities, such as home enhancements or cost savings.

Furthermore, ARMs usually come with a cap framework that restricts just how much the rate of interest rate can enhance during modification periods, offering a level of predictability and protection against extreme fluctuations on the market. This function can be especially helpful in an increasing rate of interest atmosphere.

Additionally, ARMs are optimal for purchasers who plan to market or re-finance before the financing adjusts, allowing them to take advantage of the reduced rates without direct exposure to possible price increases. As a result, ARMs can act as a calculated monetary tool for those who fit with a degree of threat and are aiming to maximize their purchasing power in the existing real estate market. In general, ARMs can be a compelling option for wise property buyers seeking flexible financing options.

Government-Backed Finance Alternatives

FHA loans, insured by the Federal Housing Administration, are excellent for first-time homebuyers and those with reduced credit report. They commonly need a lower down settlement, making them a prominent option for those who might have a hard time to save a considerable amount for a standard loan.

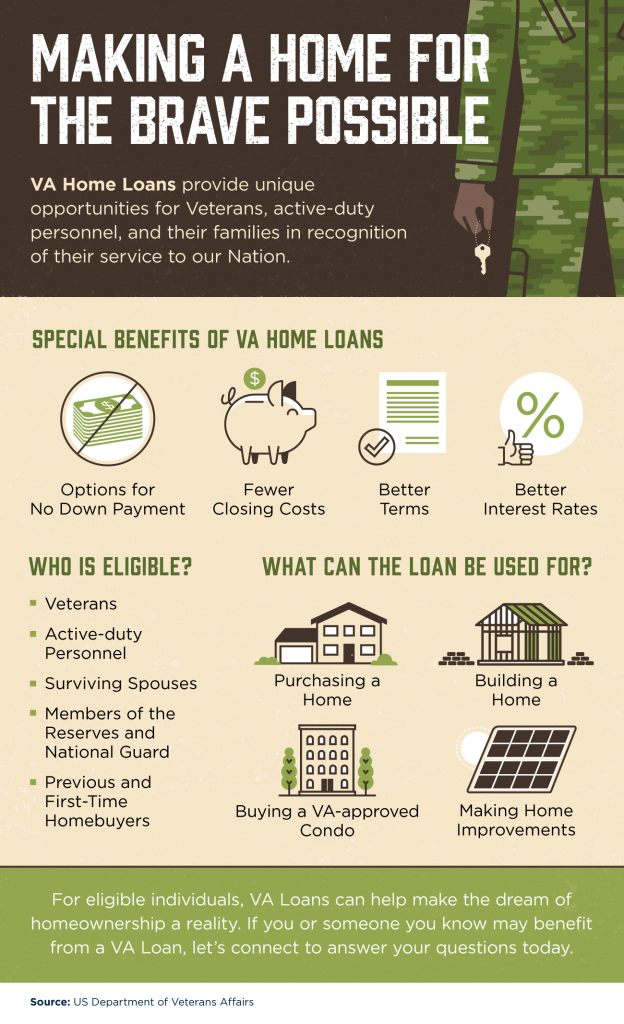

VA lendings, available to navigate here veterans and active-duty military personnel, provide beneficial terms, consisting of no down repayment and no private mortgage insurance (PMI) This makes them an eye-catching alternative for qualified debtors seeking to buy a home without the problem of additional prices.

Tips for Picking the Right Finance

When assessing loan choices, borrowers typically profit from completely analyzing their financial circumstance and lasting goals. Beginning by determining your budget plan, that includes not only the home purchase rate but also additional prices such as real estate tax, insurance policy, and maintenance (VA Home Loans). This detailed understanding will lead you in selecting a loan that fits your monetary landscape

Next, take into consideration the kinds of financings available. Fixed-rate home mortgages offer stability in monthly repayments, while adjustable-rate home mortgages might provide reduced first prices but can vary in time. Examine your danger resistance and just how lengthy you plan to remain in the home, as these elements will certainly affect your loan choice.

Additionally, scrutinize rate of interest and charges connected with each loan. A reduced interest rate can considerably decrease the overall cost over time, but bear in mind closing costs and various other costs that could counter these cost savings.

Final Thought

To conclude, browsing the landscape of home mortgage discloses countless versatile financing options that accommodate varied customer requirements. Comprehending the complexities of various loan kinds, including government-backed lendings and adjustable-rate home mortgages, enables educated decision-making. The benefits provided by these funding techniques, such as lower first repayments and tailored advantages, ultimately enhance homeownership availability. A thorough examination of offered alternatives makes sure that prospective home owners can protect the most suitable financing option for their one-of-a-kind monetary situations.

Navigating the complexities of find out here now home financings can frequently really feel challenging, yet comprehending adaptable funding options is vital for potential property owners. A home lending, or home mortgage, is a type of financial debt that permits people to obtain money to buy a building, with the property itself offering as collateral.Key components of home finances consist of the major amount, interest rate, car like this loan term, and month-to-month payments.In verdict, navigating the landscape of home loans exposes numerous adaptable financing choices that provide to varied borrower demands. Understanding the details of numerous loan kinds, consisting of adjustable-rate home loans and government-backed finances, enables informed decision-making.

Report this page